Healthcare Law Alert: HHS Announces New Usage and Reporting Deadlines for Provider Relief Fund Recipients

6/23/2021

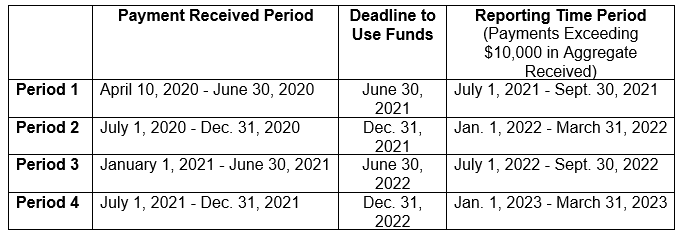

The U.S. Department of Health & Human Services (HHS) has released an updated Notice of Reporting Requirements (Notice) for healthcare providers who received one or more Provider Relief Fund (PRF) payments exceeding $10,000 in the aggregate during any “Payment Received Period.” The new deadlines to expend funds and to report on the usage of funds varies depending on the time period during which the PRF payment was received. PRF recipients who do not report within the respective reporting time period are out of compliance with payment Terms and Conditions and may be subject to recoupment.

PRF recipients must use the payments only for eligible expenses and lost revenues until the applicable deadline shown in the table below. The PRF payments may be used for eligible expenses that were incurred prior to receipt of those payments so long as the purposes of expenses are to prevent, prepare for, and respond to coronavirus.

A payment is considered received on the deposit date for automated clearing house (ACH) payments or the check cashed date. The reporting time period for each Payment Received Period is also shown in the table below.

Prior to reporting, PRF Recipients must first register on the new Reporting Portal which is now open. Providers are encouraged to register in advance of their reporting time period.

For the purposes of registration and reporting in the Portal, the “Reporting Entity” is the entity that registers its Tax Identification Number (TIN) and reports on payments received by that TIN and/or its subsidiary TINs.

Data to be Reported

PRF recipients first will report an overview of the Reporting Entity and provide subsidiary, changes in ownership, and tax and single audit information. Next, recipients will report interest earned on PRF Payments and other assistance received, such as SBA assistance, including the Paycheck Protection Program, and business insurance.

Expenses

Recipients then will report on payment usage for expenses, which categories will include general and administrative and/or other healthcare-related expenses by quarter. Expenses must be those that another source has not reimbursed and is not obligated to reimburse. The Reporting Entity also will report on unreimbursed expenses attributable to coronavirus (net after other assistance received and PRF payments are applied), also broken out as general and administrative and/or other healthcare-related expenses.

General and administrative expenses include, but are not limited to, the following:

- Mortgage/rent

- Insurance

- Personnel

- Fringe benefits

- Lease payments

- Utilities/operations

- Other costs not captured above that are generally considered part of general and administrative expenses.

Healthcare-related expenses include, but are not limited to, the following:

• Supplies

• Equipment

• Information technology

• Facilities

• Expenses, not previously captured above, that were paid to prevent, prepare for, and/or respond to coronavirus.

Reporting Entities that received $500,000 or more in aggregated PRF payments during each Payment Received Period are required to report on the use of these payments in greater detail.

Lost Revenues

PRF payment amounts not fully expended on healthcare-related expenses attributable to coronavirus may be applied to patient care lost revenues, if applicable. Recipients may choose to apply PRF payments toward lost revenues using one of three options, up to the amount:

Option 1: of the difference between actual patient care revenues;

Option 2: of the difference between budgeted (prior to March 27, 2020) and actual patient care revenues; or

Option 3: calculated by any reasonable method of estimating revenues.

For Option 1, although the Notice does not specify, it is presumed that the time periods to be compared for actual patient care revenues are the applicable quarter in which the PRF funds are being used and the corresponding quarter prior to the pandemic.

Reporting Entities will submit revenues/net charges from patient care (prior to netting with expenses) by payer mix and by quarter for each quarter during the period the funds are available for usage. Payers include Medicare Parts A, B, or C, Medicaid/Children’s Health Insurance Program (CHIP), commercial insurance, self-pay patients, and other sources of revenue for patient care services. Reporting Entities electing Option 1 will provide actual figures and Reporting Entities electing Option 2 will provide both budgeted and actual figures.

Other Data

Reporting Entities also must report on personnel and patient and facility metrics and answer survey questions regarding the impact of PRF Payments in various categories, including overall operations, maintenance of solvency, staff retention, and other impacts.

Note that PRF recipients that expend a total of $750,000 or more in federal funds (including PRF payments and other federal financial assistance) during their fiscal year are subject to Single Audit requirements.

Up to date information on the reporting requirements can be found on the HHS website.

For additional information or assistance, contact:

Lani M. Dornfeld, CHPC, Member, Healthcare Law, at 973-403-3136 or ldornfeld@pagconcepts.com

John D. Fanburg, Managing Member and Chair, Healthcare Law, at 973-403-3107 or jfanburg@pagconcepts.com

Joseph M. Gorrell, Member, Healthcare Law, at 973-403-3112 or jgorrell@pagconcepts.com

Carol Grelecki, Member, Healthcare Law, at 973-403-3140 or cgrelecki@pagconcepts.com

Related Practices: Healthcare Law

Related Attorney: Lani M. Dornfeld, John D. Fanburg, Joseph M. Gorrell, Carol Grelecki